Vena Network

Vena Network - Open Protocol to Implement Asset and Token Exchange Financing

We can build and exchange a digital network where people can communicate with P2P financial systems and OTC trading anytime, anywhere, most likely between currencies and currencies.

Application of Multi-Chain & Cross-Chain Asset Transactions

The distributed jury network serves as the

primary mechanism for protecting transactions Venak Nodes can leverage transaction costs by building nodes based on the Vena Protocol

Application on Fiat-to-Cryptocurrency Loans ( ETH, BTC, etc.) and transactions

The two parties to the transaction do not need to rely on a trusted third party broker, the transaction security is guaranteed by the protocol

Use Aragon software to achieve decentralized management

Vena Node Network

The main task of the Vena Node network is to: to promote the Vena network liquidity. Vena Nodes can use Vena SDK to customize and deploy comprehensive transaction services, including, but not limited to, loans, investment transactions, credit reporting, contract plug-in contracts, etc., and receive a revenue stream from collecting fees.

qualification

Certified Vena Nodes must have qualifications and experience in the microcredit business and abide by the laws, regulations and policies of the place where they operate.

Guarantee

Certified vena nodes must deposit VENA tokens in the Vena Foundation as a guarantee for a certain percentage.

High liquidity

Certified vena nodes can place orders in a common pool of liquidity, vena nodes can share orders and earn fees by promoting transactions and improving the liquidity of the transaction network through economic incentives to profit sharing.

safety

Users' digital assets are kept in their wallets or locked in Smart Contract. Vena nodes do not contain users' digital assets, which eliminates the moral hazard of a platform running away. At the same time, the security costs associated with depositing assets for nodes are also greatly reduced.

➔ Juror Application

In order to join the Vena Network jury, an application must first be submitted to Vena DAO and a proof of identity must be provided. After the application has been approved, it is necessary to take part in the online training and assessment of the Vena Jury

➔Calculation

All arbitration software runs on the infrastructure created by Ethereum and IPFS. Through a simple user interface, the jury can easily obtain and communicate the evidence presented by both parties

➔ Economic incentive and guarantee

deposit To motivate the jurors to properly practice jury power, the jury deposits a specific set of VENA tokens in Vena DAO

➔ Leave the mechanism

An exit mechanism will be initiated if circumstances occur during the term of the contract as follows: A. Juries voluntarily to leave B. Punished more than five times during the contract period. C. Vena DAO Committee decides that the jury has obvious misconduct (such as conspiracy to fraud)

Jury Network

The Jury Network is used in situations where Smart Contract is unable to handle Smart Contract.

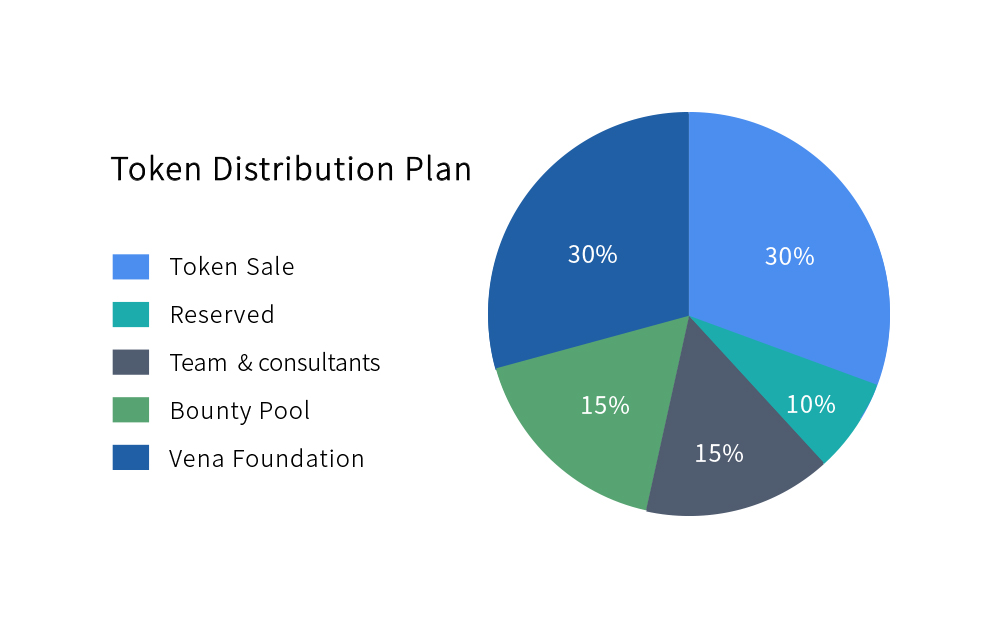

Token Distribution

Plan The total amount of VENA token issuance is 1 billion. And team, advisor, private sale, crowdfunding, foundation and incentive pool tokens are distributed via smart contracts as follows:

➽ Team and Advisor: This portion accounts for 15% of the total issued VENA tokens, 1/4 of the portion is distributed immediately after token issuance; the remaining 3/4 of the part will be blocked for one year, and after the one-year vesting period, the tokens will be distributed as follows: 1) VENA tokens of advisors will be distributed immediately; 2) 1/4 of the team's tokens will be distributed immediately and the rest will be distributed in stages over a 12-month period.

➽ Private Sale: Private VENA tokens are distributed in two ways: 1) The portion of the tokens that are not included in the lock-up plan will be exchanged for the participant's wallet within 2 days of the listing distributed; 2) The part of the tokens that are included in the lock-up plan is blocked after the listing in the smart contract, which is gradually released according to the defined rules and distributed to the purses of the participants.

➽ Public sale: After public sale, this part will be distributed to the purse of the participants within 2 days.

➽ Foundation: This part is held by Smart Contract and unlocked monthly in two years. The use of released funds is subject to the approval of Vena DAO with the disclosure of details during use.

➽ Bounty Pool: Each year, team and community developers receive a 1% share for 10 years. The remaining 5% are used for the introduction of important resources, including talents, strategic partners, etc.

➽ Reservation: Through the DAO, funds can be collected from the reserved part if funds are not available to the team, or the reserved part can be transferred to the Fund pool of the Foundation in order to promote ecosystem development.

For more information about Veins network please visit below:

Website: http://vena.network/en

Telegram: https://t.me/vena_network

Twitter: https://twitter.com/VenaProtocol

Tidak ada komentar:

Posting Komentar