MUST

In recent years, the modern economy based on the speculative mechanism of the financial system has shown the ineffectiveness and inability of its existence in the future. Built from financial instruments with questionable quality, the world of financial pyramids can not stand the constructive criticism. The current state of the global financial system can hardly be called healthy and effective and this is the main reason for the global hype surrounding blockchain and tokenization technologies. New emerging technologies can now completely alter the paradigms of world economic development and the mechanisms of interaction of economic agents. The majority of socio-economic models depend on fiat currency or cryptocurrency and other precious metals.

Must.IO is the Main Transaction Standard for the economic value of micro, small and medium enterprises. The MUST ecosystem is the world's first blockchain platform that assumes the circulation of digital bonds within the scope of motor vehicle leases, equipment, special equipment, and construction. The MUST platform provides a seamless world economic transition from speculative models to value-based. MUST target the automotive market, as well as the goods market, construction, special equipment, and machinery.

The MUST system allows small and medium sized companies to receive financing for acquisition of the assets needed to produce the final product of the market.

An entity may acquire assets, judgments to be made in the final product unit of the market, and financing will also be provided in the final product unit.

This approach allows the company to realize the final product, which will be produced in the future, and to acquire the assets produced for the production of this product.

low, the project team plans the next 5 years to take 7.5% of the market and show a turnover of 40 billion USD.

This will be achieved through:

- A unique model of the digital bond MUST Digital Bond and its circulatory system on the Free exchange.

- A very tempting moment to enter the market, institutional institutions with financial constraints in IHR financing (AML, Basel II, Basel III).

- Development and decisions of authors in the field of digitalization and engineering and automotive equipment.

- System ensures return on investment, built on kilometer and hour tokenization mechanisms as well as asset monitoring.

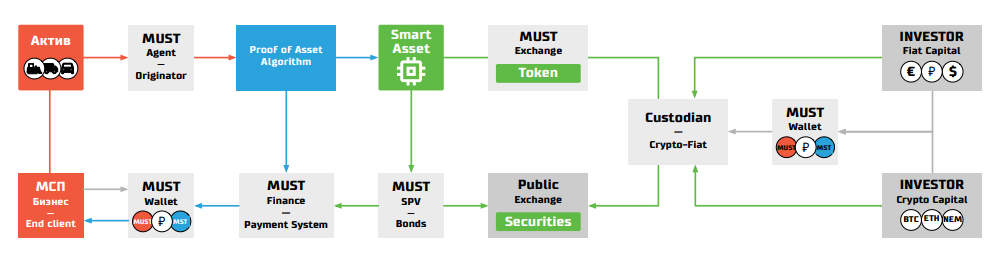

Ecosystems MUST

Under the MUST standard, our team created a decentralized financing system for small and medium sized businesses around the world, based on the final product of tokenisasi and financed market assets.

The MUST system allows small and medium sized companies to receive financing for the acquisition of the assets required to produce the final product of the market.

An entity may acquire assets, judgments to be made in the final production unit of the market, and financing will also be provided in the final product unit.

This approach allows the company to realize the final product, which will be produced in the future, and to acquire the assets produced for the production of this product.

MUST System Elements

In this system there are many different roles, b with the main business role are:

- End Client - End customers, SME entrepreneurs interested in getting access to financing. Owner of tokenized assets (Smart Asset).

- MUST Agent / Originator - Group services company MUST, acting as an operating agent in the tokenisasi transaction / asset securitization.

- Fiat Capital Investors - Private investors, banks or investment companies interested in investing in Smart Assets or Securities with certain profitability. This type of investor includes, among other things, the consumers of the final product.

- Crypto Capital Investor - Private investor, bank or investment company interested in investing capital of crypto in Smart Asset with certain profitability.

- Smart Asset - Assets that are token, verified by the guarantor and connected to the monitoring system.

- Proof of Asset Algorithm - The unique algorithm of tokenization and asset securitization. Includes: Smart Asset Tokenizer and Smart Asset Escrow.

- MUST SPV - A specialized company, issuer of securities issued on the basis of tokenized Smart Assets.

- MUST Wallet - Service for fiat exchange and crypto currency for tokens MUST, MST, and KYC user identification in the system.

- Crypto-Fiat Custodian - Service that includes a number of solutions aimed at managing the "cold" storage of crypto assets of its originators, performing classical storage functions. Provide an opportunity to take crypto assets for accounting.

- MUST Exchange - Crypto-active exchange, the main purpose is the organization of transactions for the sale of token assets. The familiar exchange interface will quickly and easily begin using new financial instruments.

- General Exchange - Classic exchange, which will trade securities issued on the basis of Smart Assets.

Products MUST

- MUST Renta - leasing services for SMEs.

- MUST Lending is a financing service (loan) secured by tokenized assets for IHR.

- MUST Escrow is a service to finance trade transactions through tokenisasi assets to be financed under the transaction.

- MUST Digital Bonds (MDB) - Digital bonds issued in the securitization process, based on token assets and cash flows on them.

Token Holder

The token holder must have access to all ecosystem services and offers from a value-based economy. Token MUST grant the holder the right to discount when paying commissions on MUST Exchange according to the following schedule:

- HB - 2019 Q4 - 50%

- 2020 Q1 - 2020 Q4 - 75%

- 2021 Q1 - 2021 Q4 - 80%

- 2022 Q1 - 2022 Q4 - 90%All tokens received by the MUST system as commission payments will be burned. After listing on the exchange, tokens MUST also be exchanged for crypto-active or other fiat currencies.

Number of tokens issued 500 000 000 Additional emissions not provided. And tokens MUST be issued according to the ERC223 standard on the Ethereum network.

Sales Token

- Private PreSale /25.02 - 30.06.2018 /Bonus + 20%

- Public PreSale / 01.07 - 31.07.2018 /Bonus + 10%

- Sale of Public Token / 01.08 - 30.08.2018 /Bonus 0%

Fee Token

- 1 MUST = 0.10 USD

- Soft Cap = 6 700 000 USD

- Hard Cap = 35 000 000 USD

- Sales Token - 350 000 000

- Team - 50 000 000 (hold up to Q3 2019)

- Marketing & Advisors - 25 000 000

- MUST Foundation - 75 000 000 (hold up to Q3 2020)

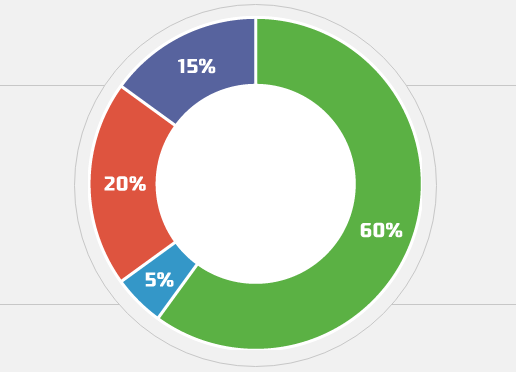

Investment Distribution

- R & D - 15%

- Legal - 20%

- Marketing - 60%

- Operational cost - 5%

ROADMAP

Q2 2015

Start

Start working on standard technology description;

Prototype Q3 2016

The first version of the Inspect app;

Q1 2017

Auction Auction

and testing of business models;

Q3 2017

Rebranding

The first version of the market MUST.Ru;

Q3 2017

Presentation

The official release of MUST.Ru at COMTRANS 2017;

Q3 2017

Stock Exchange MUST

Launch MUST Checking Inspection Exchanges;

Q1 2018

MUST Renta RU

MUST Audit EN

MUST Price EN

MUST Check

MUST be Standard 1

Q2 2018

MUST Monitor EN

MUST Index

MUST Agent RU

SHOULD be a RU Expert

MUST Auction RU

Q3 2018

HAVE TO BE A Digital Bond

Must be changed

Q4 2018

MUST Loan RU

Q1 2019

MUST EU Audit

MUST EU Inspections

MUST UNION EUROPE

MUST EU experts

MUST EU Auctions

Q2 2019

MUST HAVE EU

MUST be an EU Agent

MUST Monitor EU

Q3 2019

MUST Loan EU

Q4 2019

MUST AUDIT AF

MUST CHECK AF

MUST PRICE OF

SHOULD BY EXPERTS

MUST AF Auction

Q1 2020

SHOULD Hires AF

MUST Agent AF

MUST Monitor AF

Q2 2020

MUST LEND AF

Q3 2020

MUST LAT Audit

MUST Check LAT

MUST LAT Price

MUST LAT Experts

LAT MUST Auction

Q4 2020

SHOULD HAVE TO HAVE LAT

MUST be a LAT Agent

MUST Monitor LAT

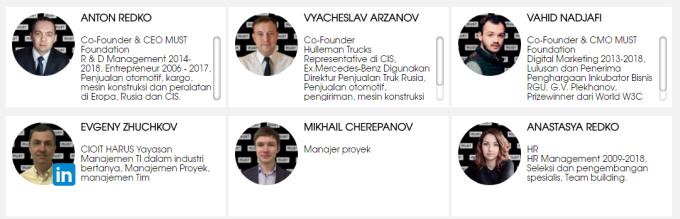

TEAM

Conclusions and References

In essence, it can be concluded that Must.io is the main standard of the main transaction for the economic value of micro, small and medium enterprises. Funding system available decentralized economic value of micro, small and medium enterprises through tokenization kilometers and hours.

FOR MORE INFORMATION

Website: https://must.io/

Ann Thread: https://bitcointalk.org/index.php?topic=4509154

Whitepaper: https://must.io/whitepaper. pdf

Facebook: https://www.facebook.com/mustfinex

Twitter: https://twitter.com/mustfin

Telegram: https://t.me/must_en

Instagram: https://instagram.com/mustfinance

Tidak ada komentar:

Posting Komentar