TradeRiser

Introducing TradeRiser

The growth of the world wide web led to innovations in search engine technology. This made the web more accessible and ubiquitous. However financial data analytics, has not enjoyed the same the level of simplicity and accessibility seen in the world wide web. The growth of big data cannot be stopped, financial firms and individuals alike are in a race to find trading opportunities. This task will only get harder as new avenues of data are discovered, human beings will struggle to keep up. This disconnect in accessibility and ubiquity presents a huge opportunity, to systems that seek to democratize financial data analytics.

TradeRiser is an artificially intelligent Research Assistant, that can answer simple and complex trading questions. To train the artificial intelligence we will be leveraging the blockchain to build an incentivization system, which will be supported and fed by data from a large network of quantitative analysts and researchers. A token based economy called XTI will be introduced, to incentivize researchers, for their data and contributions to the platform.

Solution

TradeRiser solves these problems through its Research Assistant that can immediately answer trading questions that a trader or investor has about the financial markets. TradeRiser’s token mechanism will keep track and compensate financial analysts for their datasets of questions, data validation, accuracy checking, suggestions and example report creation. The financial analysts can contribute in these ways to help train our machine learning Research Assistant, and be compensated accordingly. XTI is the underlying mechanism used to facilitate this ecosystem, and provides XTI holders with direct participation in advancing our “single source of truth” questioning and answering system.

Why Blockchain?

The blockchain ledger is a publicly-verifiable record that can be used to confirm that both the financial analysts and content producers on our system have been compensated for their contributions. Research consumers looking for premium reports that is in the Research Marketplace section will also have the confidence that payments have gone towards the content producer for the selected reports, with a dependable system-of-record always available as an accounting of their usage

Financial analysts are like freelancers or contractors, the blockchain allows TradeRiser to create smart contracts with the financial analysts for various pieces of work. Our commercial transactions and agreements will be executed automatically, it will enforce the obligations that the financial analysts have in a contract. It provides an automated collaborative approach for data gathering using a large diverse pool of financial analysts. The smart contract allows for the different stages of work carried out by çto be rewarded.

Costs Cutting

In bid to bring as many financial analysts and onto the ecosystem, we want to reduce the friction associated with transferring capital between parties. Friction such as clearing costs and counterparty risks, will be eliminated by using our XTI mechanism on the blockchain.

Reaching Critical Mass

One of the biggest challenges of TradeRiser is getting our Research Assistant model to reach critical mass. In other words getting it to a place, in which it can answer the majority of trading questions it’s users will have. The system needs to be trained on a large universe of question, events and market data.

Phase one addresses the way to acquire the data set of questions. This will be done by TradeRiser issuing the XTI tokens as compensation for the ongoing contributions to building the knowledge base, from which the machine learning will be done from. Once critical mass has been reached, executing phase two in attracting research consumers onto the platform will be easy. With both the research consumers and content producers now fully on the ecosystem, the research consumers will now be able to reward the content producers for their premium content and voting. This ongoing cycle will create a chain effect, thus attracting more contributors to the platform.

Platform Features

- Community Edition :- This is comprised of many features that will be available to the community. They are as follows, the Research Assistant powered by the community data feed, ICO ratings, market condition analysis, ICO due diligence, investor portfolio analysis, direct trading, web and mobile app.

- Research Marketplace - Accessible to Token holders

- Enterprise Edition :- This standalone version is accessible to financial institutions, hedge funds or corporations. This includes our API.

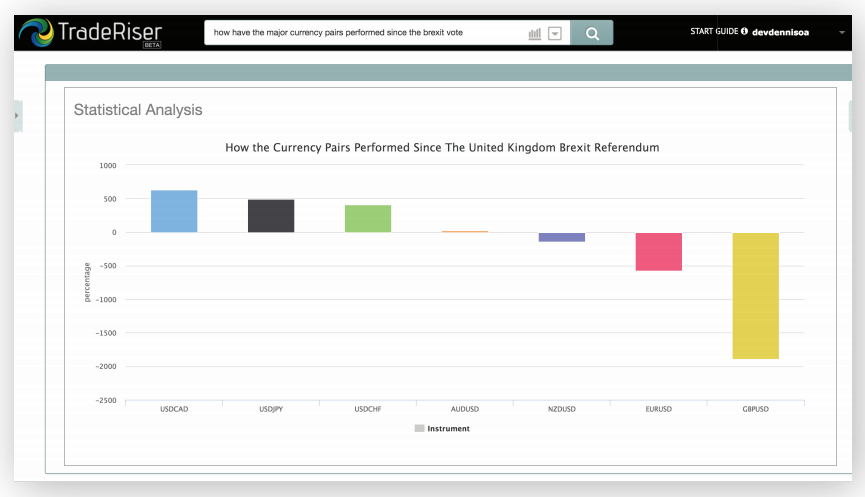

Current Platform: Market Fit

TradeRiser has built an alpha/private beta version of the Research Assistant, this can be accessed on request or signing up at www.traderiser.com. The alpha/private beta version focuses on forex, commodities and indices, and will allow users to ask questions surrounding the economic calendar events, technical analysis, correlation and performance and more. This version has been built predominantly for demonstration purposes and data capturing.

Our intention is to transform this into powerful fully fledged Research Assistant that will accompany all corners of the trading and investing space. So far it has been seen by major investment banks and technology vendors, and has received a lot of positive feedback

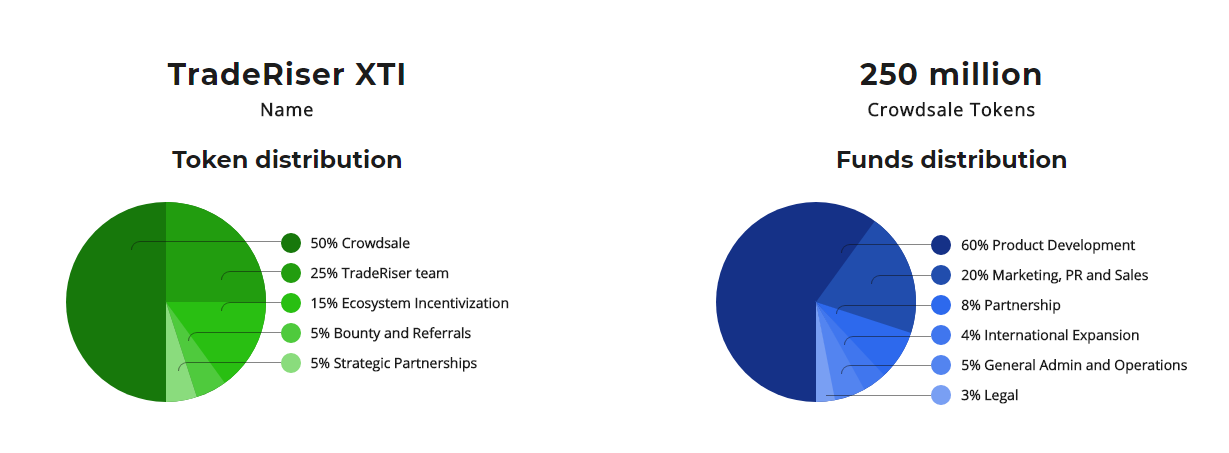

Token

● Target on crowdsale: $23,000,000

● Total in existence: 500,000,000 XTI

● XTI Token type: ERC20

● Purchase methods accepted: BTC and ETH

● Based on Ethereum blockchain and the Ethereum smart contract

Employee allocation of XTI will have a vesting period of 24 months, with a 6 month cliff.

Allocation will be proportional to the tenure of each employee by the date of token sale.

Unsold tokens will be burnt.

PRE - ICO

ROUND VALUE

1 XTI = $0.07

ICO

ROUND VALUE

1 XTI = $0.10

XTI Supply

XTI will have a supply with nominal value USD 23,000,000.

XTI Refunds

In certain cases, XTI may be refunded to platform participants. For example, use cases may arise that will necessitate a refund, but typically will follow a minimum period of 3 weeks before this takes place.

Roadmap

2014 to 2015

TradeRiser is founded

2016 Q1 to 2016 Q3

Private Beta/Alpha test with traders and asset managers

2017 Q1

Participated in the Accenture Fintech Innovation Lab London

2017 Q2 to 2017 Q3

Platform UI redesign and functionality improvement

2018 Q3

TradeRiser ICO

2018 Q3 - 2018 Q4 (June - Dec)

Growing The Team and Market Data Provider Partnerships

2018 Q4 (Oct - Dec)

Launch training portal

2018 Q4 (Oct - Dec)

Launch Community Edition of TradeRiser

2019 Q2 (Apr - June)

Hedge Fund and Financial Institution Partnerships

2019 Q4 and Beyond

Launch Research Marketplace and Enterprise Edition

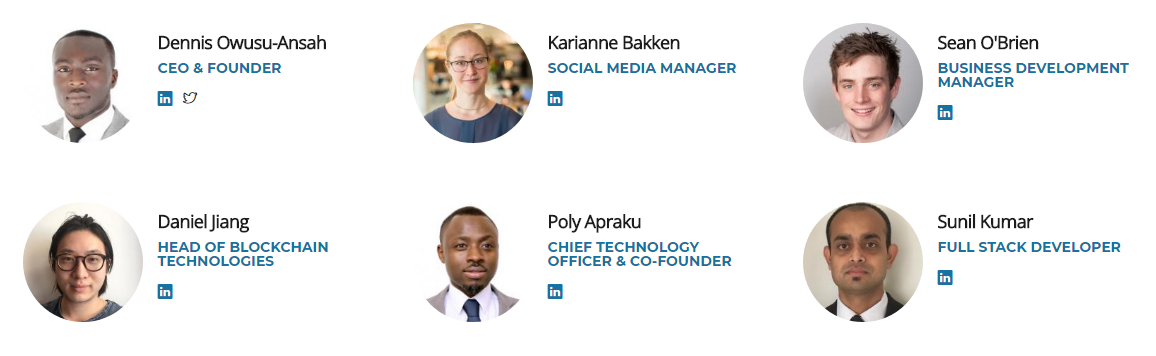

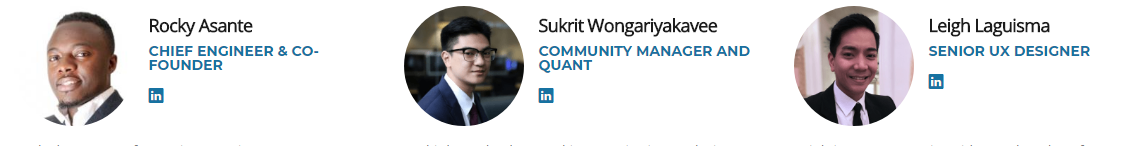

Team

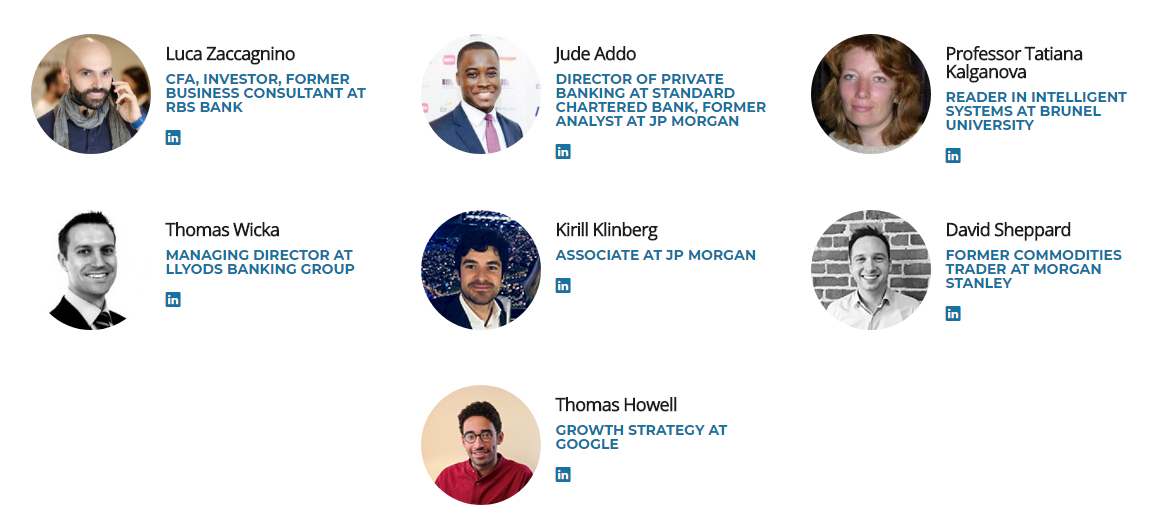

Advisors

For more information please visit the link below

Website: https://www.traderiser.com

Twitter: https://twitter.com/TradeRiser

Telegram Group: https://t.me/traderiser

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3835944.0

Forum Username : APEL MALANG

Forum Profile link : https://bitcointalk.org/index.php?action=profile;u=1953438

Tidak ada komentar:

Posting Komentar