BLACK INSURANCE

Black is a digital insurance company in blockchain. Our platform connects insurance brokers directly with capital allowing them to launch their own virtual insurance company. Thereby removing a trusted third party (Insurance Company) from the value chain. In the 1600s, Edward Lloyd runs a coffee shop in London where merchants, bankers, and sailors come to do business. Lloyd is known for offering the best class of intelligence on shipping, related risks, and other similar matters. It became a popular place for two classes of people to meet: those who wanted to insure their ships from major damage, and others, who were willing to take the risk and pay compensation when it happened. To insure potential debris, risk takers begin to receive payments, or premiums. The modern insurance market, as we know it.

Black is here to make a difference

Black will use the blockchain to transfer risk directly from clients

(insureds) to financial backers (Black Syndicate Token holders):

- Minimizing all inefficiencies.

- Storing all data securely in blockchains.

- Transparent business operations using smart contracts.

- Faster innovation by platform members.

Black will fix the insurance industry fundamentally. Black is an insurance platform like Lloyds of London on blockchain without the expense, delays and bureaucracy that we witness today.

Black Insurance will use two types of tokens :

- Black Platform Token (BLCK)

BLCK powers the infrastructure, providing access to the platform and for conducting voting on system updates to the platform (utility token). All platform users will use BLCK for managing insurance on the Black platform, and demand for BLCK will increase as more insurance business is conducted on the platform.

- Black Syndicate Tokens (BST)

(issued when the platform is ready) BST is an investment in insurance capital, and a specific BST is created for each syndicate (security token), The profitability of the insurance portfolio for a specific syndicate will pass-through to the holders of it’s BST.

Our Solution

Black will be a licensed insurance company that provides insurance capacity to Agents, Brokers and MGAs (hereinafter “Brokers”) enabling them to launch their own virtual insurance companies. Our capacity comes without the traditional overheads of insurance company while using blockchain as main platform to get rid of centralized insurance companies.

We connect the idea to the capital directly, replacing the parties that are not needed in the value chain with technology. We will do this through crowdfunding, also giving smaller investors a way in. This leaner model gives more responsibilities to insurance brokers and control over the products they are selling. Insurers as we know them today are simply a trusted third party – blockchain gives us an alternative to that and the need for insurers disappears.

Cost Analysis

We’ve done an analysis about data on the listed insurance companies across the world. We will show that the costs that occur for standard insurance companies that Black would almost eliminate, are quite significant. We have gathered financial data from various international and Estonian insurance companies

between 2013 and 2016. The data shows that administrative expenses are quite high in the industry, thus there is a lot of cost cutting possible. It also becomes clear that smaller insurance companies would be first to fall, as their administrative expenses are relatively high to their gross written premiums.

Insurance companies have costs for admin expenses and net profit of Gross Written Premium. The industry average is 20%. This is calculated by taking the average sum of the admin and net profit margins data of insurance companies provided in this blog post.

Black collects fees from users for using the platform for different actions. For example: syndicates fund an insurance product with capital. Black Insurance’s fee will be a % of the GWP (Gross Written Premium). Fees to be paid in BLCK tokens. Black Foundation will sell the tokens on the market to cover costs of operation: Development, HR, admin, legal & marketing. A surplus of tokens will be kept in the company reserve for occasions when costs rise and use of the platform is lower.

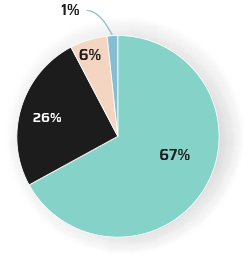

Token Distribution

Token Name: Black Platform Token

Token Symbol: BLCK

Soft Cap: US $2,000,000

Hard Cap: US $45,000,000

Maxsimum supply assuming that all tokens are sold with maximum discount: 471,082,089

ICO structure :

Pre-Sale Starts – 7/31/2018

Pre-Sale Period – 30

Pre-Sale Cap – $15,000,000.00

Pre-Sale Terms – First week 25% bonus and after first week 20% bonus

Token Sale Starts – 8/31/2018

Token Sale Period – 30 days

Soft Cap – $2,000,000.00

Hard Cap – $45,000,000.00

Token Symbol – BLCK

Total Number of Tokens – 471,082,090

Exchange Rate – 1BLCK = 0.2 USD

Minimum Purchase – $100.00

Accepted Cryptos – BTC, LTC, ETH

Adjustability – Undistributed tokens will be destroyed by token contract.

Listing – BLCK tokens will be listed on crypto exchanges

Token Holder Benefits – BLCK can be used to pay for services on Black platform. Black will guarantee that until 1st of January 2021 service fees paid with BLCK will be at least 20% cheaper than service fees paid in any other currency.

Token Trade Limitation – Only Team and Advisors have vesting and sales lock-in periods

Our Road Map

- Oct – Nov, 2017 Ideas and teams are organized.

- Nov, 2017 The product concept is ready.

- December, 2017 Seed Financing.

- May, 2018 MVP Launched.

- Summer, 2018 ICO general sales.

- December, 2018 Platform launched.

- Summer, 2019 EU license.

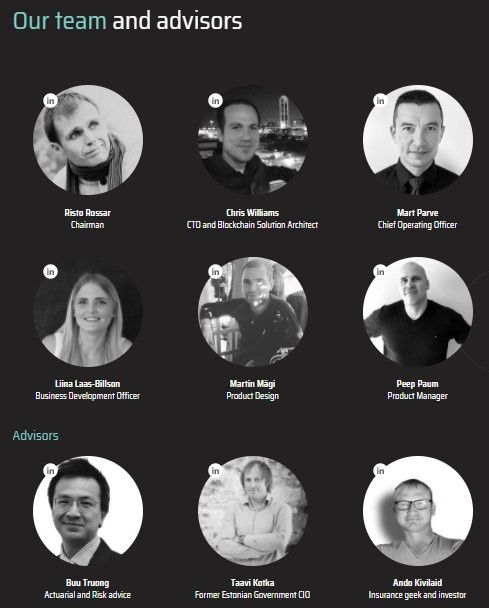

Team

The team consists of insurance industry veterans and blockchain experts. It is a great mix of inside knowledge of the insurance industry, expertise on blockchain technology and the crypto space. Founders have over 18 years of experience in insurance software and saw the pressing need for a solution that would democratize the field through technology.

Website : https://www.black.insure/

Whitepaper : http://www.black.insure/whitepaper/

Twitter : https://twitter.com/BlackInsure

Facebook : https://www.facebook.com/blackinsure

Telegram : https://t.me/blackinsurebot

Bitcointalk : https://bitcointalk.org/index.php?topic=3372186.new#new

Tidak ada komentar:

Posting Komentar