FinWhaleX

About

FinWhaleX is a P2P credit lending platform that provides access to loans anywhere and anytime. Let’s take a look at how this works. In order to apply for a loan, the borrower must first set the parameters for the loan. These include the amount, interest rate, loan term, etc. Sometimes the company recommends evaluating the parameters of other applications in order to more easily navigate the process and select the most advantageous offers. In addition, there are options for choosing an application for a loan on bail. Two ways can be offered for this. First, you can place an application for secured lending. This method is more attractive. Second, you can transfer the required amount of collateral after the lender accepts the application. The commission for filing a loan application is 0.5% of the amount depending on the loan term.

How FinWhaleX Works

- 1. You place a loan application

When creating your loan application, the Borrower sets parameters according to his choice (amount, interest, period, etc.). We recommend evaluating the parameters of other applications that have been placed on FinWhaleX - lenders choose the most profitable application for themselves. You can choose when to secure loan applications with collateral. There are two ways available. On the one hand, you can place guaranteed loan applications that are more attractive to creditors. On the other hand, you can transfer the amount of collateral required after the creditor receives your application. When placing a loan application, you need to pay a transaction fee of 0.5% of the loan amount depending on the loan period.

- 2. Loan providers receive your loan application

All creditors guarantee to fulfill their obligations for applications received. After the lender receives the application, FinWhaleX will generate a multisig address specifically where your collateral (bitcoin) will be stored until the end of the loan period. Each party only has one private key for a multisig address. Multisignature (multisig) refers to requiring more than one Private key to authorize Bitcoin transactions. This guarantees that no one can access the guarantee which only has one Private key.

- 3. You return money within the loan period

After repaying the loan, you automatically return the deposit to yourself. No one can use your bitcoin until the loan is repaid - they are frozen in a special wallet. You cannot return a loan, if it is not profitable for you. If the bitcoin level hasn't gone up or down, then you can refuse to repay the loan. In this case, the guarantee only falls to the lender, and your loan obligations are repaid.

Token Info

Token name: FinWhaleX

Symbol: FWX

Type: ERC20

Platform: Ethereum

Token Distribution:

-56% for sales

-17% for teams and advisors

-15% reserve

-12% Marketing and PR

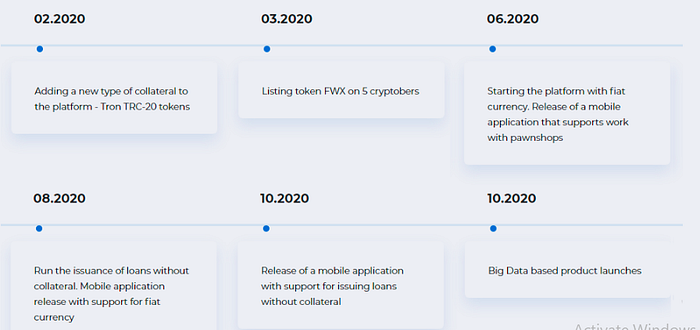

Roadmap

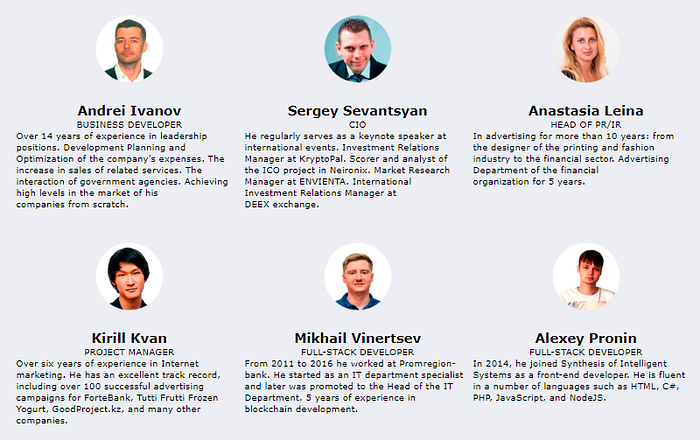

team

information

Website: https://finwhalex.com/

Telegram: https://t.me/finwhalex

Facebook: https://www.facebook.com/FinWhaleX/

Twitter: https://twitter.com/FinWhaleX/

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1953438

Tidak ada komentar:

Posting Komentar